Created in 2025, the Illinois Gives Tax Credit Act offers a 25% state income tax credit to donors that make gifts to eligible permanent endowment funds held at Qualified Community Foundations. Grants from eligible permanent endowment funds must provide grants for the benefit of Illinois residents or charities and projects in Illinois.

There is a limited amount of funds available for this program. We encourage you to plan early to take advantage of this credit and contact Galesburg Community Foundation to ensure your gift is eligible.

View more detailed instructions below

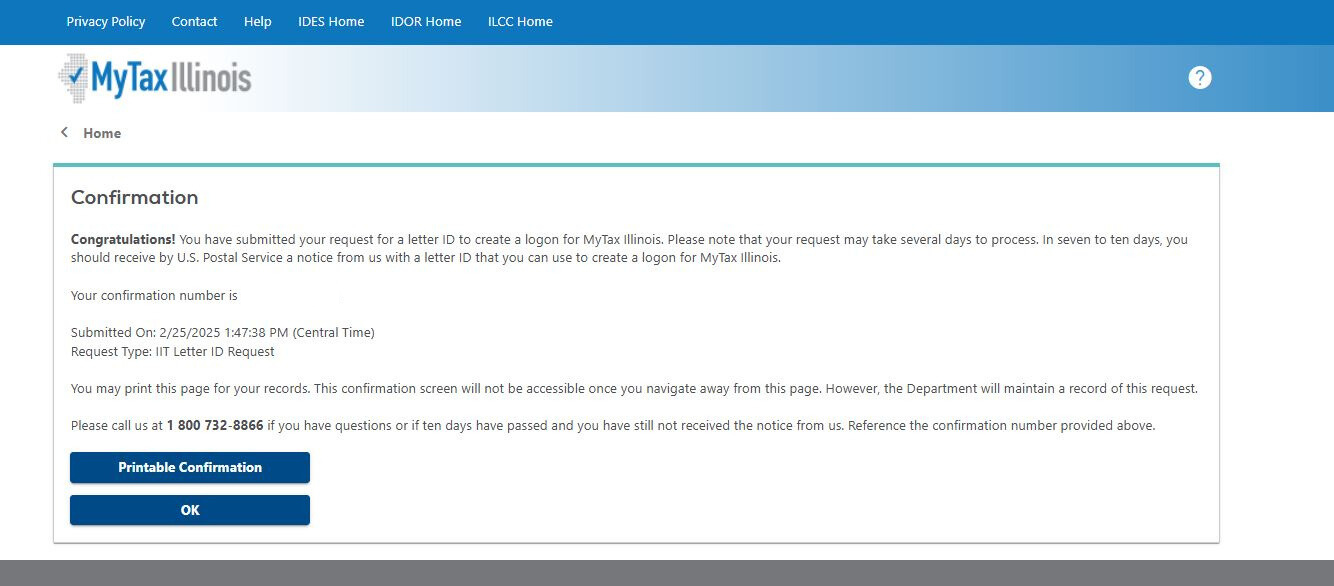

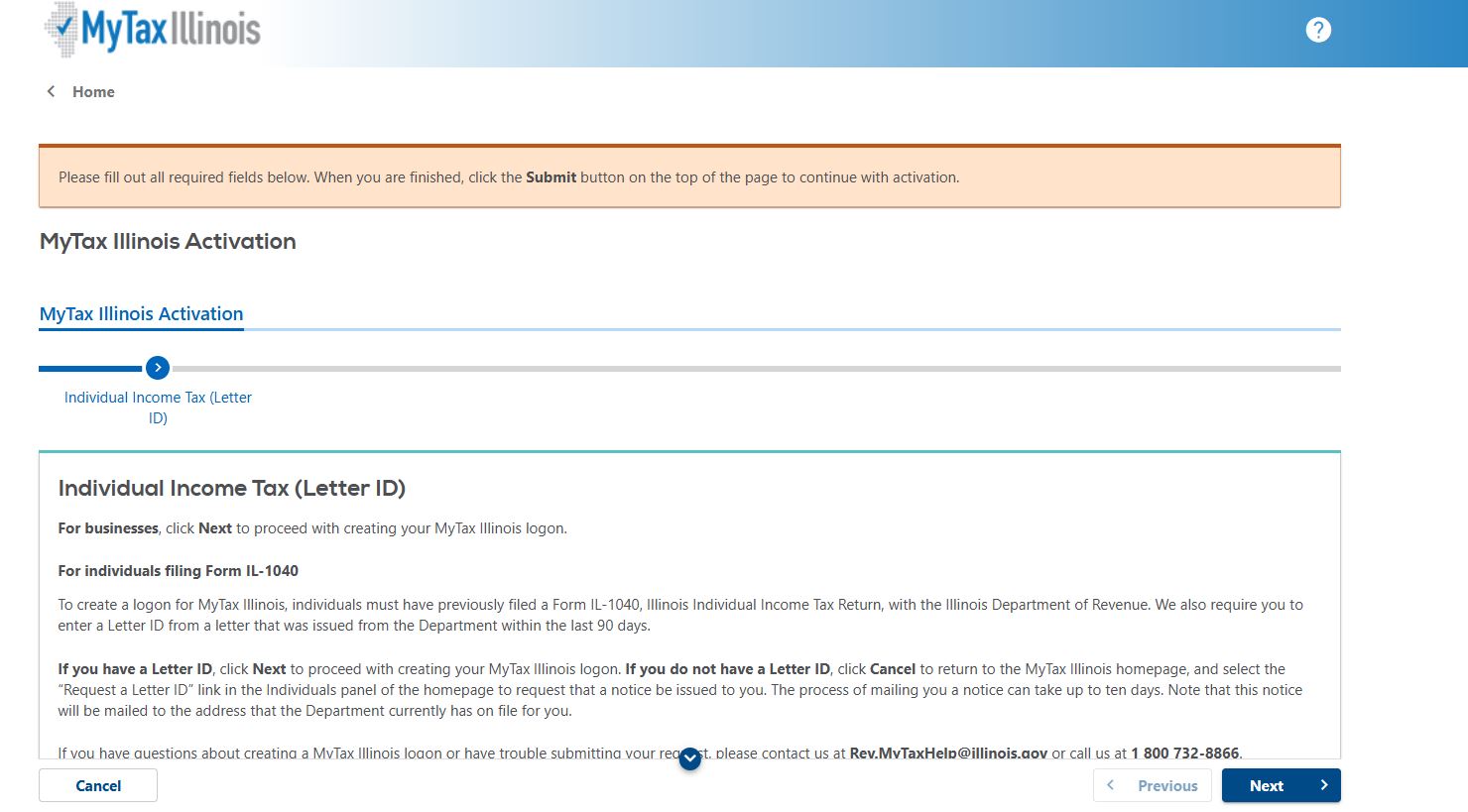

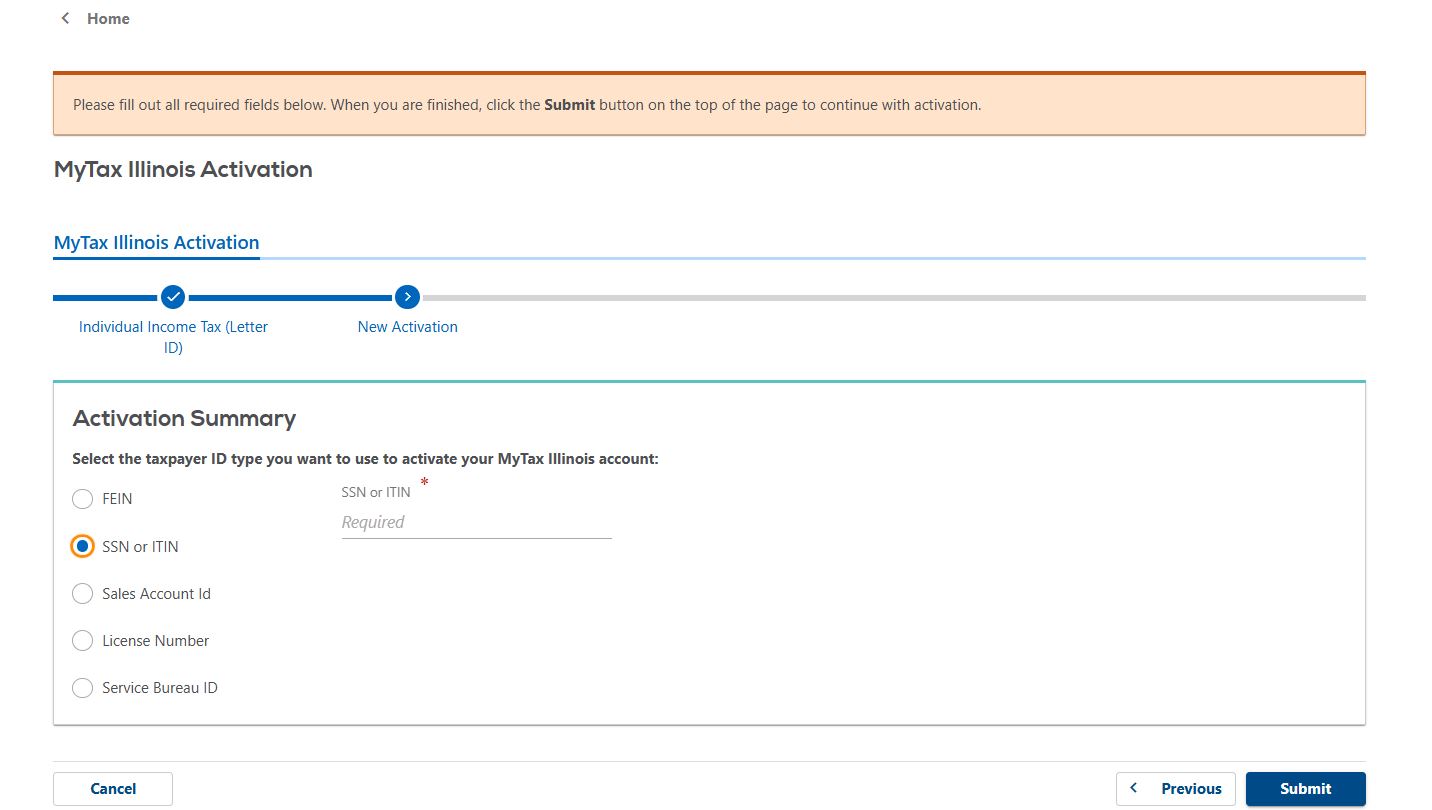

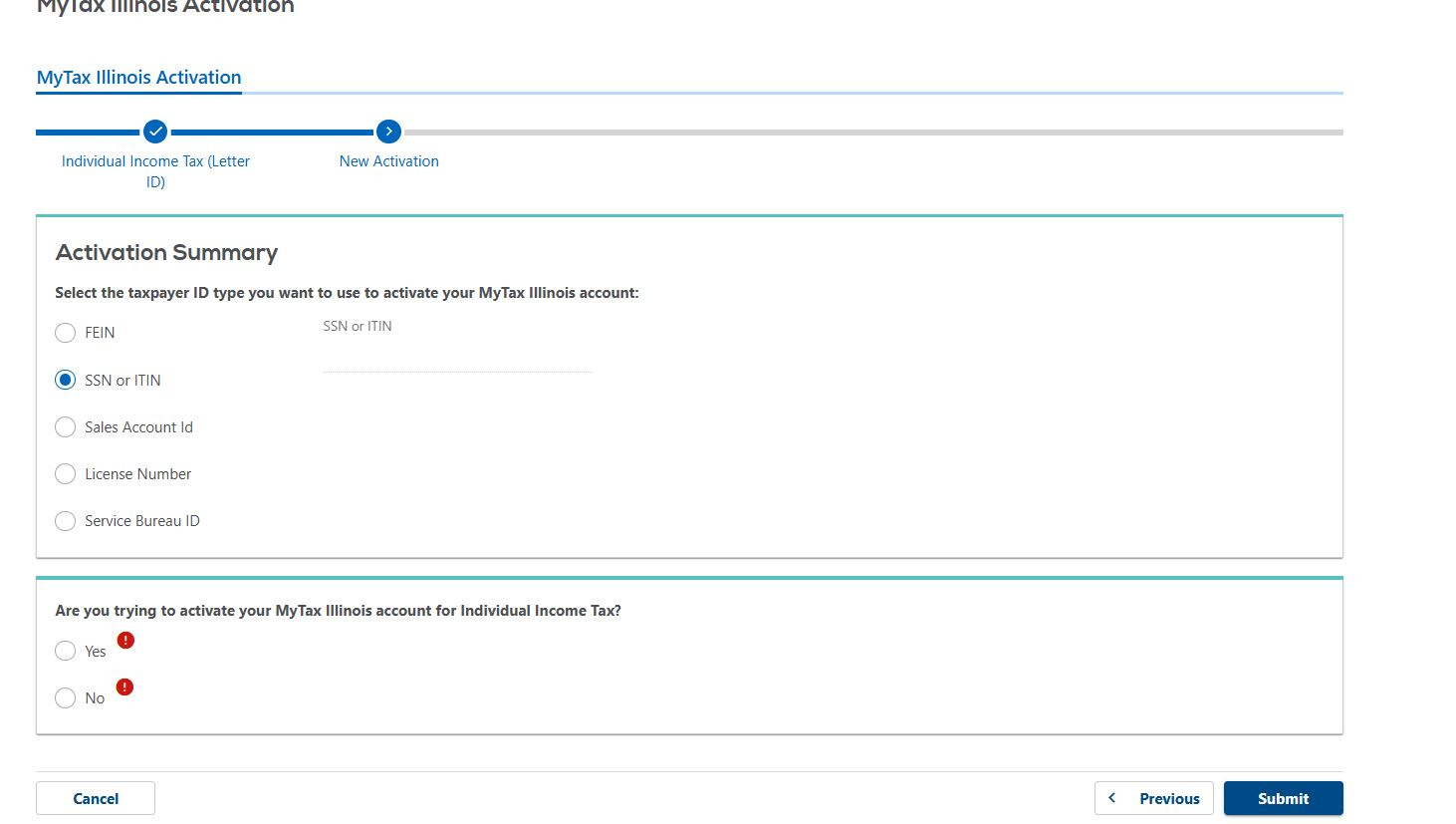

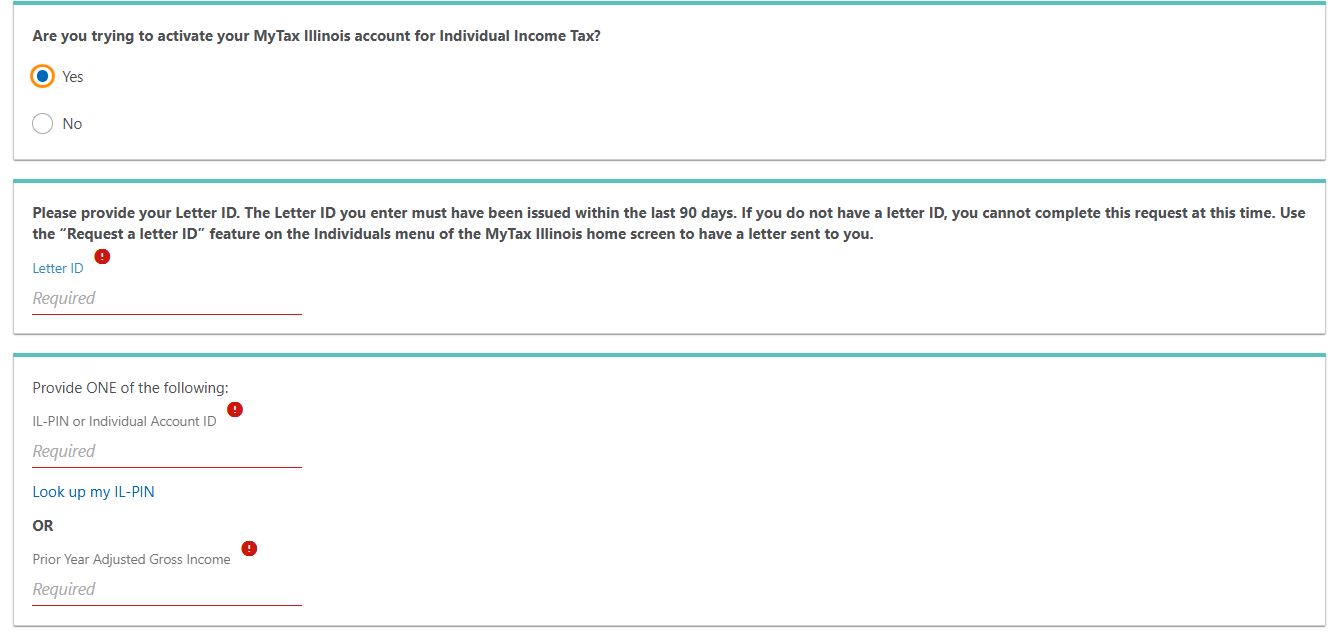

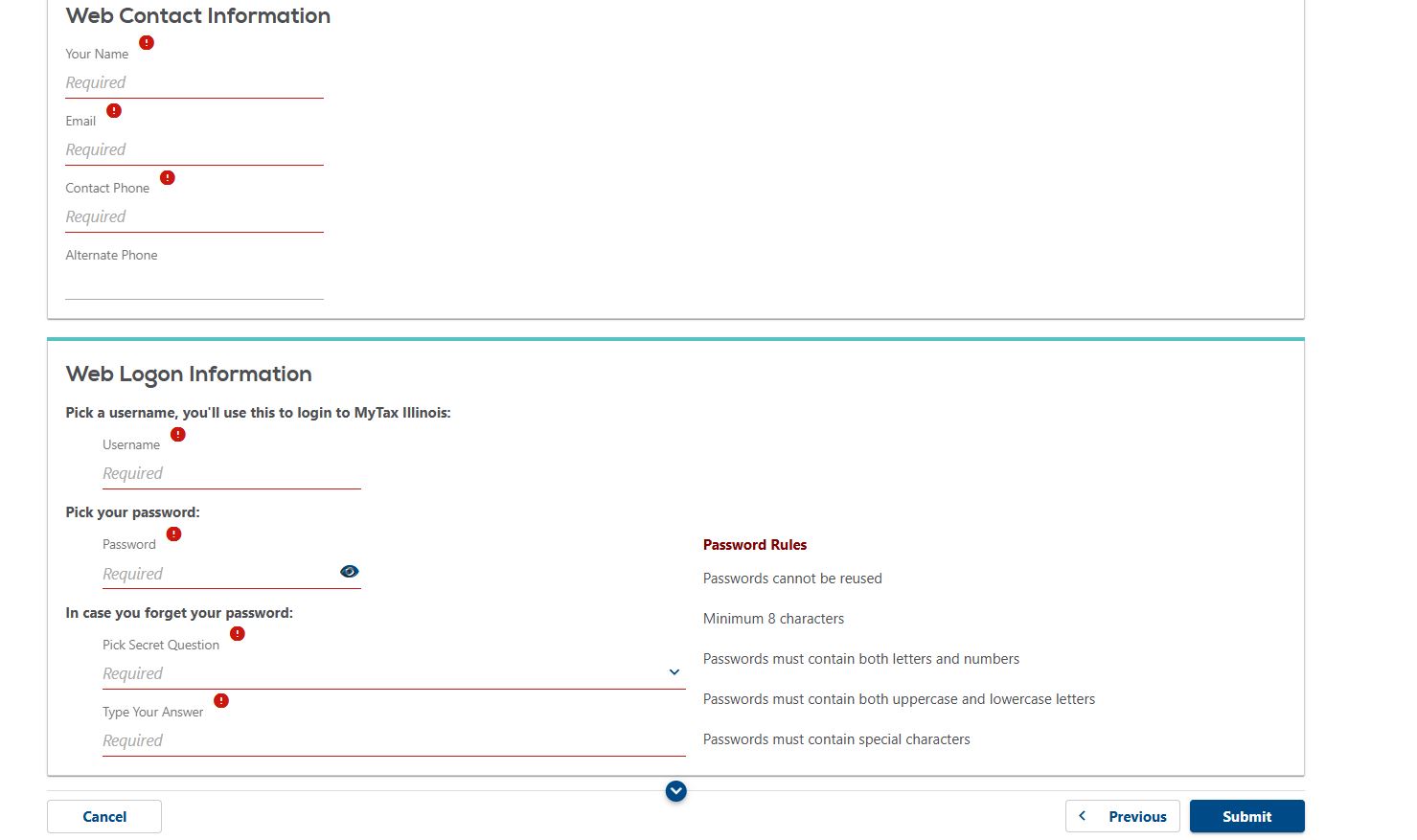

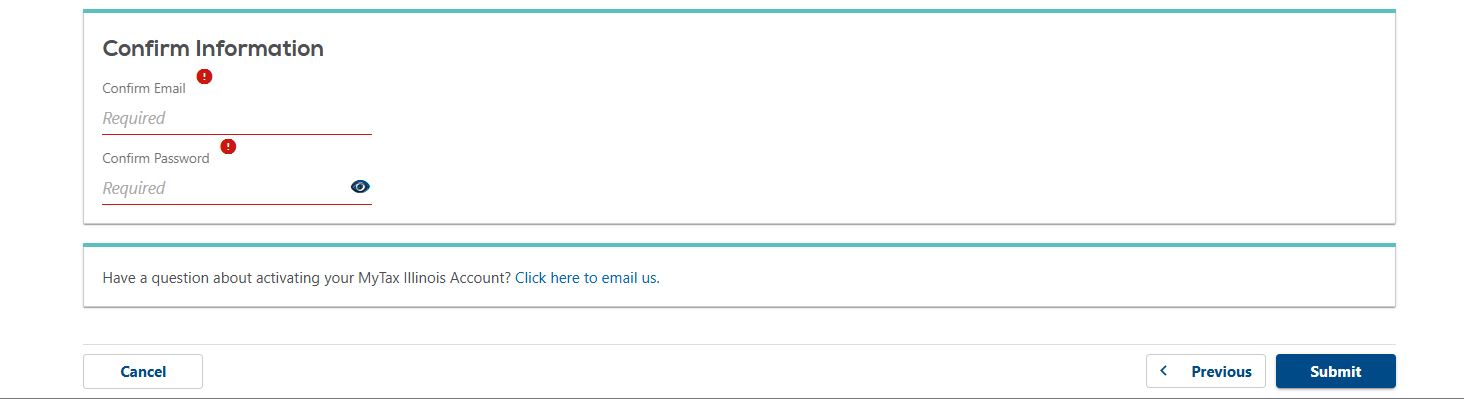

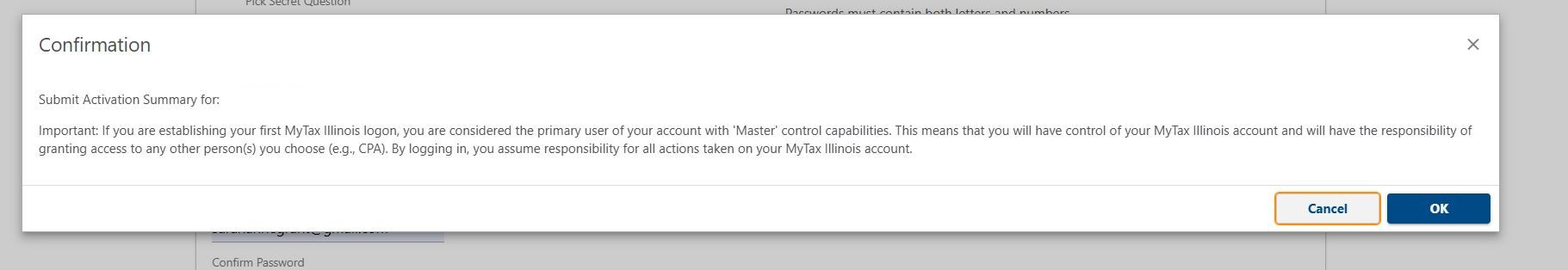

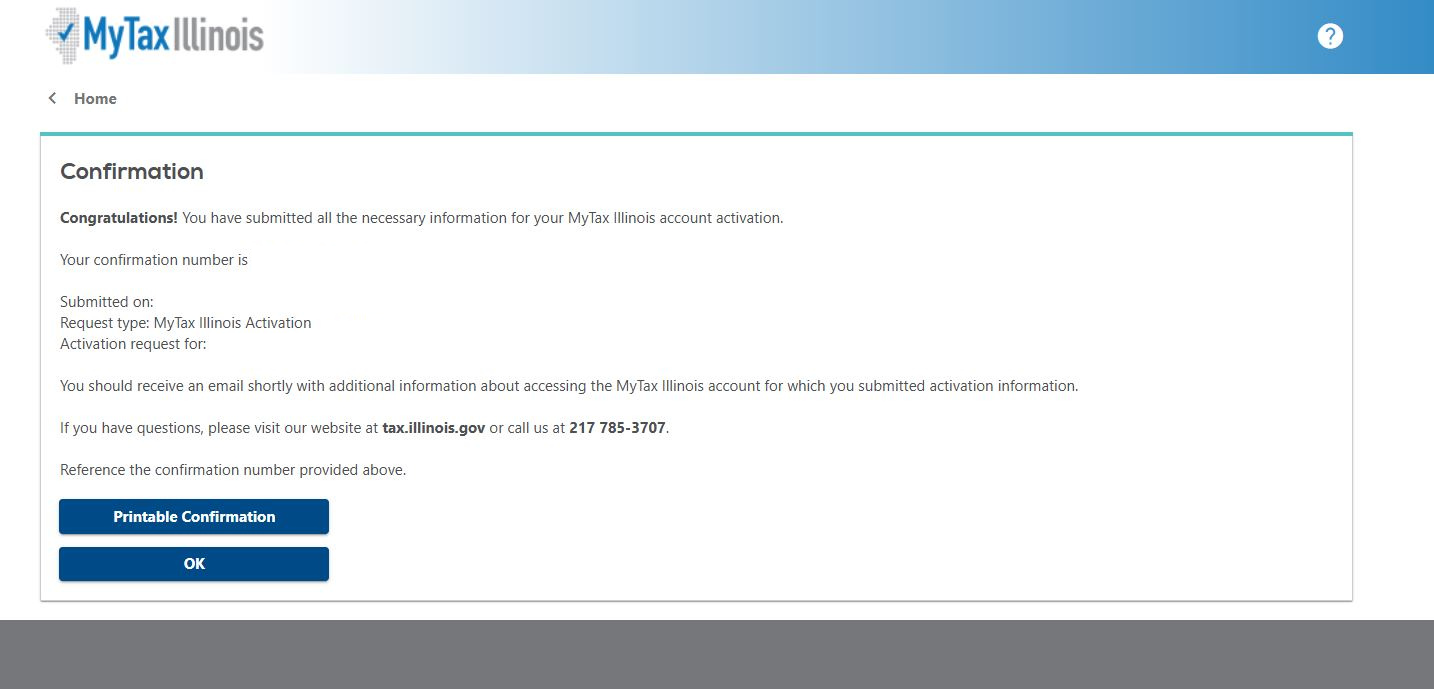

The Illinois Gives Tax Credit utilizes the MyTaxIllinois website. If you don’t already have an account, please follow the two-step process to create your account.

To create an account at MyTaxIllinois.gov you must first request a MyTaxIllinois ID Letter.

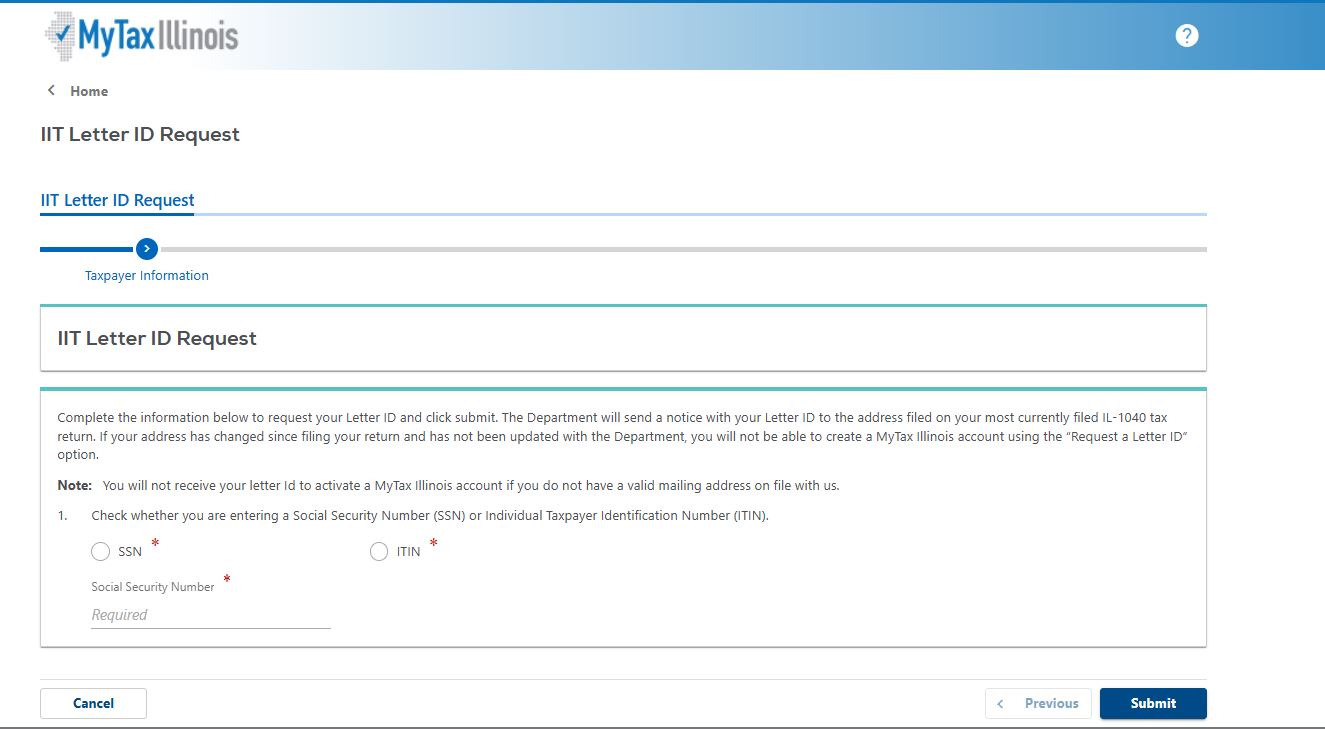

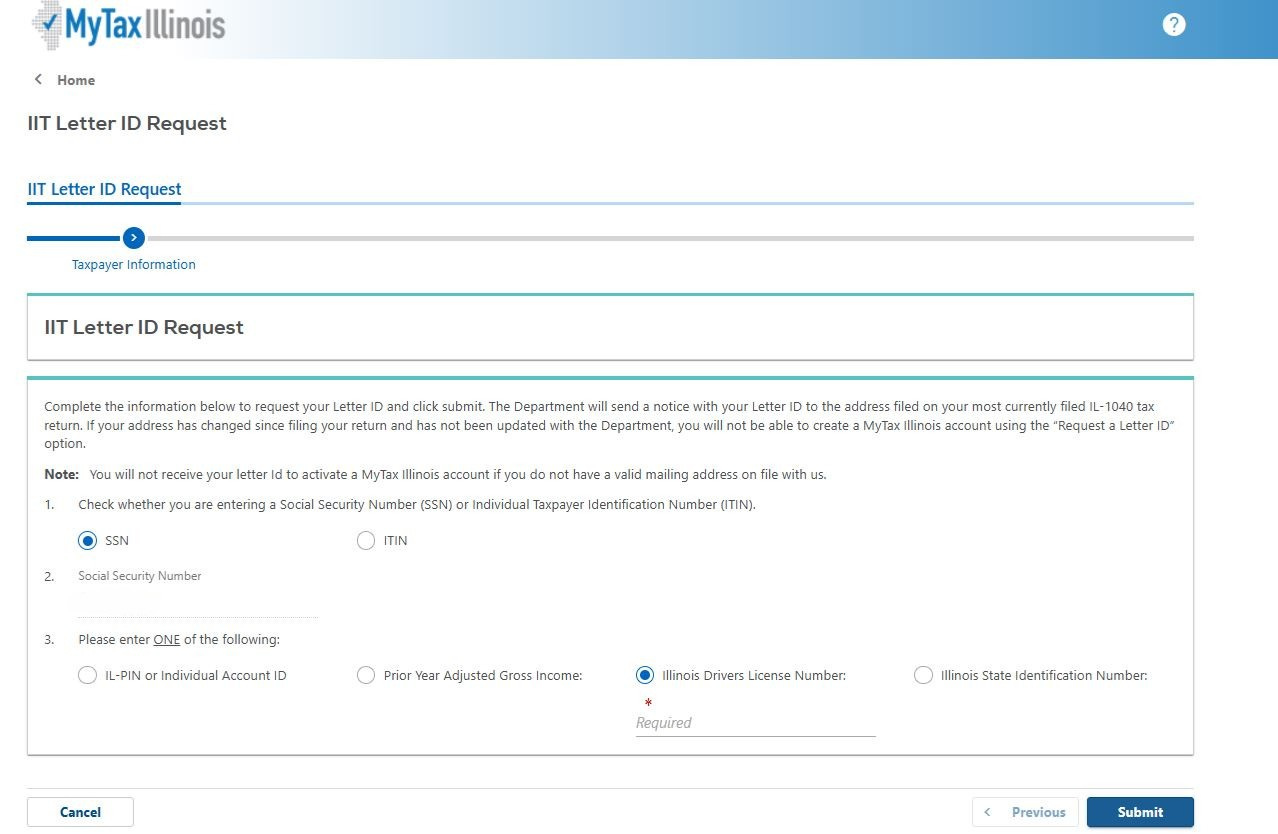

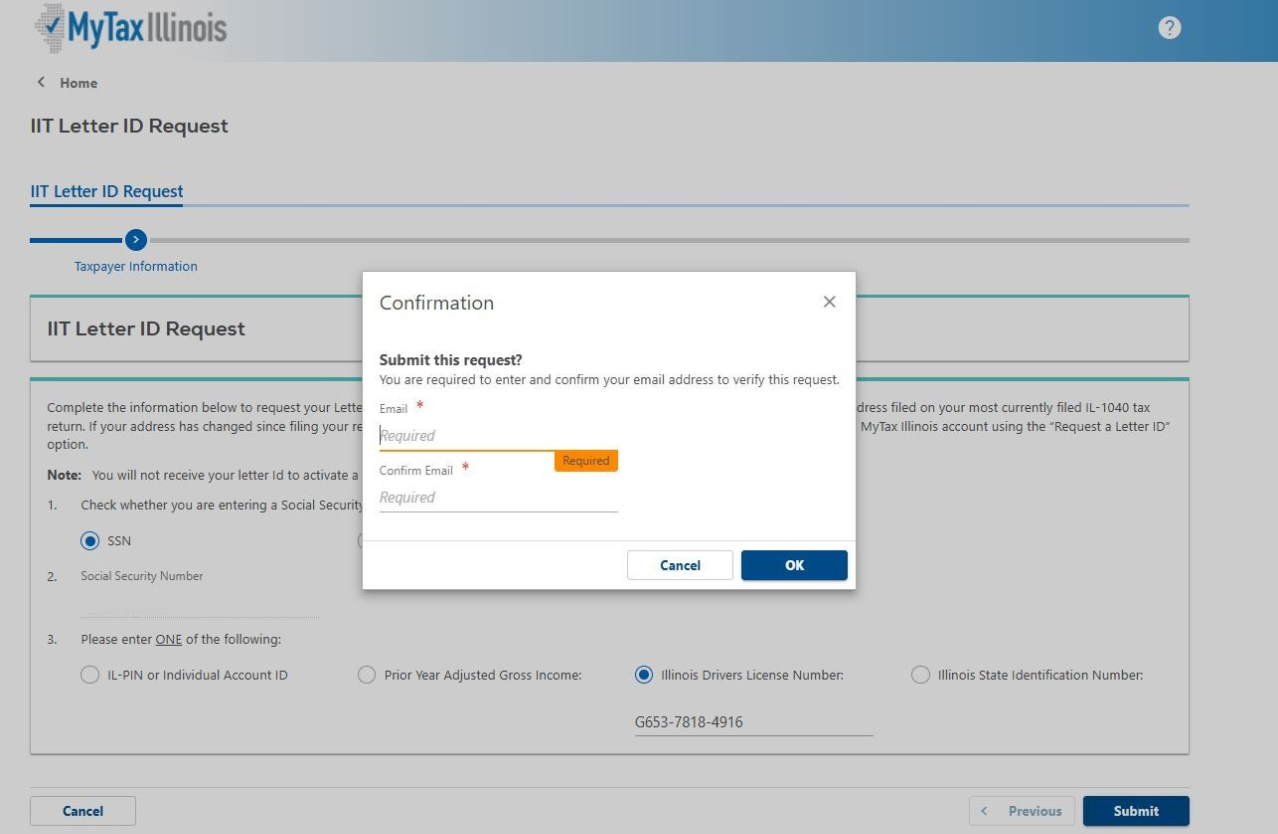

Instructions for requesting a MyTaxIllinois ID Letter:

To learn more about the Illinois Gives Tax Credit or for assistance with the application process, call Sarah Grant, Director of Development, at 309.344.8898.

Charitable Giving Coordinator

Haley provides support to enhance the function and success of the Charitable Giving and Affiliate Teams. She ensures donors receive a personal approach to philanthropy through outstanding customer service by supporting charitable giving for donors and fund holders across the state.